Administrative assistants are responsible for a wide range of administrative tasks that support management. They can help with research and writing letters. They are responsible for managing telecommunications as well as date-entry. Here are some job descriptions for a secretary or personal advisor. They are sometimes also known as administrative professionals or personal assistants. To get started, learn about the benefits of this position and how to apply. The BLS program for administrative assistants is worth your consideration.

SS Assists In Telecommunications

BSS (Business Support Systems) and OSS (Operations Support Systems) are technologies that allow network operators to access the business-facing functionality and customers they need in order to deliver services to their subscribers. OSS and BSS help network operators create and manage their customer relationships, create offers, issue bills, and handle cross-carrier transactions. These two technologies can be used together to improve network operations. This article outlines the differences in OSS and BSS.

FAQ

What does an accountant do? Why is it so important to know what they do?

An accountant keeps track all the money that you earn and spend. They keep track of how much tax is paid and allowable deductions.

An accountant can help you manage your finances and keep track of your incomes and expenses.

They assist in the preparation of financial reports for both individuals and businesses.

Accounting professionals are required because they need to be able to understand all aspects of the numbers.

A professional accountant can also help with taxes, so that people pay as little tax as they possibly can.

What is an Audit?

An audit is a review or examination of financial statements. To ensure everything is correct, an auditor reviews the company's financial statements.

Auditors look for discrepancies between what was reported and what actually happened.

They also ensure that financial statements have been prepared correctly.

What is the average time it takes to become an accountant

Passing the CPA test is essential in order to become an accounting professional. Most people who want to become accountants study for about 4 years before they sit for the exam.

After passing the test, one has to work for at least 3 years as an associate before becoming a certified public accountant (CPA).

What is the value of accounting and bookkeeping

Bookkeeping and accounting are important for any business. They can help you keep track if all your transactions are recorded and what expenses were incurred.

They will help you to avoid overspending on unnecessary items.

You must know how much profit each sale has brought in. You'll also need to know what you owe people.

You might consider raising your prices if you don't have the money to pay for them. However, if your prices are too high, customers might not be happy.

If you have more inventory than you can use, it may be worth selling some.

You could reduce your spending if you have more than you need.

All of these factors will impact your bottom line.

What does an auditor do exactly?

Auditors look for inconsistencies within the financial statements with actual events.

He checks the accuracy of the figures provided by the company.

He also verifies the validity of the company's financial statements.

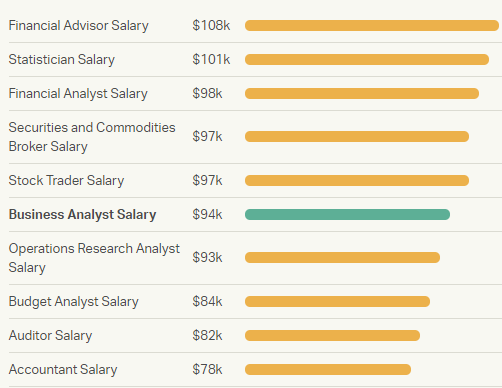

What are the salaries of accountants?

Yes, accountants are often paid an hourly rate.

For complex financial statements, some accountants may charge more.

Sometimes, accountants are hired for specific tasks. An accountant could be hired by a PR firm to prepare a report describing the client's performance.

Statistics

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

External Links

How To

Accounting for Small Businesses: How to Do It

Accounting is an essential part of managing any business. This includes tracking income and expenses, preparing financial statements, and paying taxes. You may also need to use software programs like Quickbooks Online. There are several ways to do small business accounting. You need to choose the most appropriate method for your business. We have listed the best options for you below.

-

Use the paper accounting method. Paper accounting is a good option if you prefer simplicity. This method is very simple. All you need to do is keep track of all transactions. However, if you want to make sure that your records are complete and accurate, then you might want to invest in an accounting program like QuickBooks Online.

-

Use online accounting. Online accounting is a way to have easy access to your accounts no matter where you are. Some popular options include Xero, Freshbooks, and Wave Systems. These software are great for managing your finances, sending invoices and paying bills. They are easy to use, have great features, and many benefits. These programs are great for saving time and money in accounting.

-

Use cloud accounting. Cloud accounting is another option. It allows data to be securely stored on a remote server. Cloud accounting offers many benefits over traditional accounting systems. Cloud accounting does not require that you purchase expensive software or hardware. Because all your information is stored remotely, it provides better security. It takes the worry out of backups. It makes it easy to share files with others.

-

Use bookkeeping software. Bookkeeping software is similar in function to cloud accounting. You will need to purchase a computer and then install the software. Once the software is installed, you will have access to the internet to view your accounts whenever and wherever you like. You can view your accounts, balance sheets and transactions directly from your PC.

-

Use spreadsheets. Spreadsheets enable you to manually enter your financial transactions. You can, for example, create a spreadsheet that allows you to enter sales figures each day. A spreadsheet's advantage is that you can make changes to them at any time without having to change the whole document.

-

Use a cash book. A cashbook lets you keep track of every transaction. There are many different shapes and sizes of cashbooks depending on how much room you have. You can choose to use separate notebooks for each months or one notebook that spans multiple years.

-

Use a check register. You can use a check register as a tool to help you organize receipts or payments. You simply need to scan the items you receive into your scanner and then transfer them to your register. You can then add notes to help remember what you bought later.

-

Use a journal. You can keep track of all your expenses by using a journal. This works best if you have a lot of recurring expenses such as rent, insurance, and utilities.

-

Use a diary. A diary is simply a journal that you write to yourself. You can use it for tracking your spending habits or planning your budget.